Stepping into the world of personal finance can feel like hanging out with people who have been friends forever and have all kinds of inside jokes and stories that you know nothing about. And you're just sitting there, nodding along, and trying to pretend like you aren't completely lost.

From the outside, the financial world can seem like a scary, confusing place, so welcome to Personal Finance 101. I'm going to explain some of the key topics and terms you need to understand to be able to build wealth.

Feel free to grab a piece of paper, put on some comfy pants, and grab a cup of coffee, because this is going to be a crash course in everything you need to know to start building wealth, including how to pay off debt, how much you need in an emergency fund, and how to actually invest.

https://youtu.be/ASYMb_q55Bk

1) The Wealth-Building Roadmap

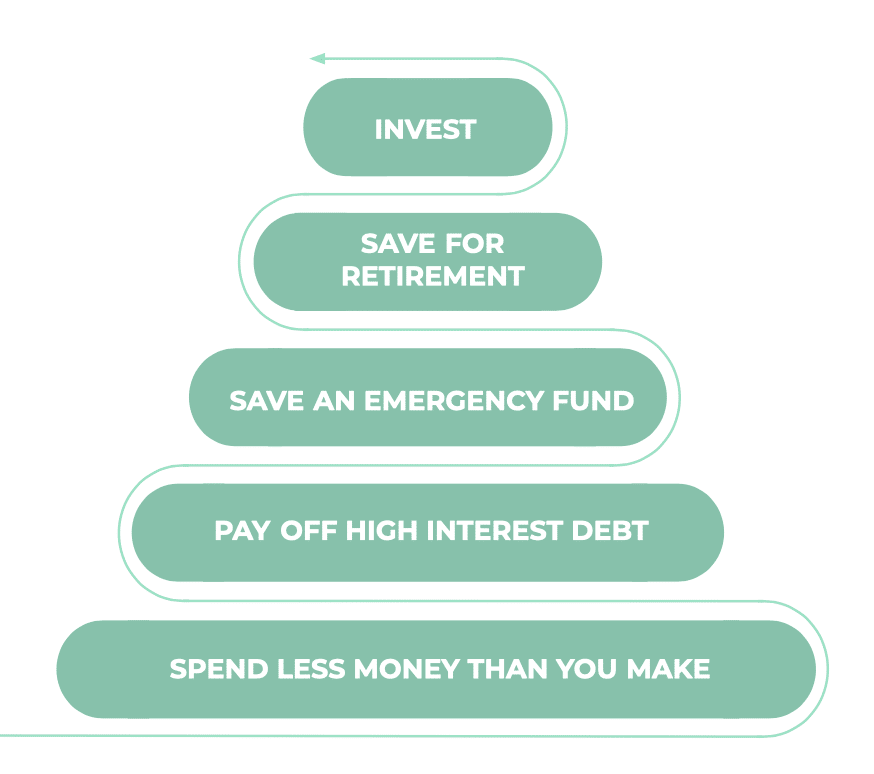

Let's start with how to build wealth, which we call our wealth-building roadmap. Remember, planning your financial journey is a lot like planning any other journey, and the wealth-building roadmap outlines the steps you need to take to build wealth and the order in which you should take them.

There are five steps on the wealth-building roadmap:

- Spend less than you make every month

- Pay off your high-interest rate debt

- Build up an emergency fund

- Save for retirement

- Invest and grow your money

Bottom line, when it comes to personal finance, it matters that you do things in the right order, so remember this wealth-building roadmap when you're wondering where to start or what to focus on next.

2) How to Set a Budget

Now that you've got the roadmap, let's dive into some important Personal Finance 101 concepts, starting with everyone's favorite: budgeting.

I recommend start with a simple budget, like the 50/30/20 method. Most budgets are too complicated and too difficult to stick with. This one is clear, straightforward, and easy to set up.

Here's how it works: you take your monthly income after taxes and you divide it into three buckets:

- 50% goes for your needs. These are non-negotiable expenses, things like rent, your health insurance, things that keep you healthy, safe, and able to work.

- 30% is for wants. Those are things that make life more fun, like a night out with friends or tickets to a movie.

- 20% goes straight into savings. This is money that's designed to take care of future you.

If you're finding it difficult to save more than you make every month, you might want to start by auto-saving a percentage of your income. Choose an amount that you can stick to, even if it's only $50 a month at the beginning. Ideally, get that up to 20% of your income, but that by auto-saving, you can only spend what you have left over.

3) APR

So now that you've got the basics of budgeting, let's talk about debt.

There's one term that's really important when it comes to debt, which is your Annual Percentage Rate (APR), the interest that you're paying on the debt that you're holding.

APRs very widely. Things like student loans and mortgages typically have a lower APR, sometimes as low as 2.5%. On the other hand, things like credit cards can have APRs as high as 25%.

Not all debt is bad, but you want to be conscientious about the amount of money you're borrowing. This affects things like your credit score, which is partially based on the amount of credit you have available versus the amount available to you.

APRs basically measure the cost of the debt for you. You want to avoid any high-interest rate debt (i.e., any debt with an APR over 7%). For example, you should avoid a car loan with a 9% APR.

The reason that you want to avoid high-interest rate debt is because of how expensive it is. When you're paying 25% interest on your credit card debt, if you buy a pair of jeans, it might cost you double in the end, depending on how long you're taking to pay off that debt.

You also need to pay that off high-interest rate debt before you start investing, because the interest that you're paying on your debt costs more than you'll make by investing. It's okay to hold onto debt with an interest rate below 7% and start investing.

4) Credit Score

Your credit score is an indication of how reliable you are at paying back money. Basically, it tells people who you're going into business with how likely you are to pay your money back on time.

Your credit score matters when you are trying to do things like rent an apartment, get a loan, apply for a credit card, even look for a job.

In the US, credit scores range from 300 to 850, and you should aim to have a credit score of at least 670. That allows you to be able to get the credit cards you want and get lower interest rates.

5) Emergency Fund

An emergency fund is money that you set aside for life's unexpected expenses. If your car breaks down or there's a leak in your roof or you lose your job, that's money that you have set aside to deal with these problems. That way you won't be forced to go into debt or to take money out of your investments.

Your emergency fund can range from six weeks to six months of expenses. If you currently have credit card debt, you only want to save $1,000 in your emergency fund for now.

If you want to learn more about emergency funds, we have a whole article where we cover topics like how big it should be, where you should keep it, what qualifies as an emergency, and other questions we get about emergency funds.

6) Retirement Accounts

Understanding all the different types of retirement accounts and finding the right one for you can be overwhelming, so I'm not gonna get into it too much here, but these are the basic types of retirement accounts you should know about:

- 401(k)s and 403(b)s are employer-sponsored accounts, accounts offered by the place you work at a relatively low cost. Sometimes they'll even include employee matching, which means that whatever amount you contribute to your retirement account, your employer puts in the same amount, up to a certain percentage. This is totally free money, and you definitely want to take advantage if your employer offers 401(k) matching.

- Individual Retirement Accounts (IRAs) are accounts that you open on your own. It comes with tax advantages so people can save and invest for the long term.

One quick note on retirement accounts: just because you have a 401(k) or an IRA, it doesn't mean you're invested. You actually have to take the money in those accounts and invest it in something for the money to grow. It's a really common assumption I hear all the time is that if you have a 401(k), you think that that money is automatically growing, but it's not.

Remember: what you should invest in depends on how old you are. If you're young, you want to invest your 401(k) in higher growth options, mostly stocks. If you're closer to retirement, you want to balance high-risk, high-reward investment with lower risk investments, such as bonds.

7) Investing

When it comes to investing, risk and reward are closely related. Often, the higher the risk, the higher the reward. The lower the risk, the lower the reward.

Different investment options tend to carry different risks. Stocks are essentially small pieces of a public company. They tend to be high-risk, high-reward. Bonds are an IOU from a company or the government. They're often low-risk but low-reward. You may have also heard of things like ETFs, mutual funds, index funds, which are just baskets of different stocks and or bonds all mixed together.

The first thing to remember when it comes to investing is not to panic. Historically the stock market always corrects itself. There's a good chance that your investments will dip at point, but just sit tight. Don't pull your money out.

Also, diversify your portfolio. If you're only invested in one thing, then if something happens to that thing, you're screwed. A diverse portfolio mitigates risk. That's why things like ETFs, mutual funds, and index funds are great investments because they automatically diversify for you.

Congratulations!! I know that was a lot, but on the bright side, you have a basic understanding of Personal Finance 101.

Now you are ready to start creating financial security for yourself and building wealth. If that is something you want, go watch our free masterclass, Think Like an Investor, and you will be on your way!

A Weekly Sip of Our Best Advice

We respect your privacy. We'll use your info to send only what matters to you — content, products, opportunities. Unsubscribe anytime. See our Privacy Policy for details.